If you’re attempting to make savings on your household’s monthly expenditure, large outgoings such as car insurance payments can seem like a major drain on your resources. In fact, a recent Sainsbury’s Finance survey found that 579,000 people had reduced or cancelled their car insurance cover over the last year as a direct result of economic pressures. This is a worrying trend: car insurance may seem expensive if you’re trying to rein in your purse strings, but its benefits significantly outweigh its potential costs – particularly since car insurance is a legal requirement in the UK.

It’s important to remember that there are a number of alternatives to cancelling your car insurance policy or doing away with your vehicle entirely. By following a few prudent steps, you could actually make significant headway in your quest to find cheaper car insurance.

Reducing your car insurance, one step at a time

For starters, if you’re in the process of buying a new car, it’s important to choose correctly in order to ensure that your car insurance premiums aren’t too high. A Porsche , for instance, may seem like the ultimate in luxurious motoring, but the car insurance on such a high-end model will have a heavy impact on your wallet. Choose your new model carefully and consider its car insurance band before you make a purchase – safe, dependable models are definitely the right way to go, and your car dealer should be able to help you make a decision.

Once your insurance is in place, it’s important to protect your no claims discount. By preserving this, the likelihood that future insurance premiums will cost less is much higher and so, with the right amount of cautiousness, you’ll be making long-term gains. The easiest way to do this is to avoid driving when you’re less confident of your abilities – at night, in the snow or during periods of thick fog. You’re also much more likely to have an accident when you don’t know where you’re going, so invest in a satellite navigation system or make sure you have watertight directions when travelling to an unfamiliar location.

Limiting the number of people insured on your vehicle could also reduce the cost of your policy. For instance, if you, your partner and your children are all insured under your car insurance policy, its cost is likely to be much higher than covering yourself only. What’s more, people that drive your car only occasionally don’t need to be insured for an entire year – some insurers will let you insure extra persons for a day or a weekend, which can be a much more cost-effective option.

Looking for a new insurer

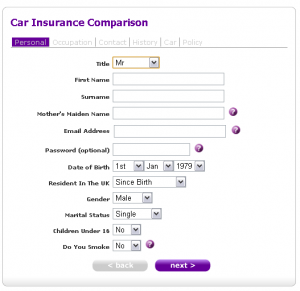

Sometimes the easiest way to get cheaper car insurance is simply to switch your insurer. Web-based insurance comparison sites provide a simple way to do this, allowing you to compare quotes as well as policy benefits. Some also offer introductory discounts – but if you’re choosing one of these policies, make sure you can afford the premiums once the discount period has elapsed. Ultimately, the key to finding a new insurer with cheaper cover is to carefullt shop around – with the right mixture of consumer know-how and prudent driving, you’ll have your premiums down to an affordable level in no time.

About Insurancewide

Insurancewide, also known as Insurancewide.com Services Limited, is an online insurance comparison website offering insurance comparison tools which allow users to search the market and procure the best insurance policies and quotes. Insurancewide was launched in August 1999 as the first insurance comparison website on the internet.

Via EPR Network

More Financial press releases