Increasing numbers of travellers are taking to the roads instead of the skies to get to their European holiday destinations, and keeping their car as a mode of transport whilst they explore their vacation destination. However, Insurancewide, one of the UK’s leading insurance comparison websites, is urging holidymakers to check the details of their car insurance policies carefully – they might not be insured for driving abroad, in which case it’s vital to compare car insurance policies to get the correct cover.

If you are whisking your family away, it certainly seems somewhat easier to load up the boot of your car, put the kids in the back seat and take to the road with your satelite navigation programmed. But if you get into an accident without the proper car insurance, or aren’t aware of the rules of the road where you go, you could have more of an adventure than you bargained for.

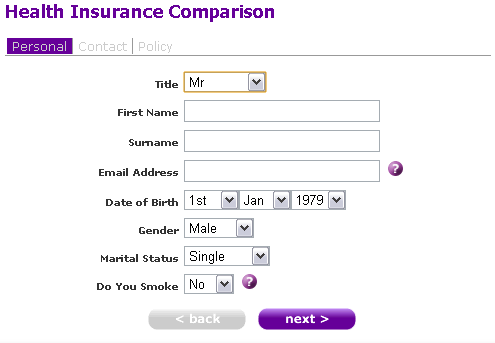

Holidays can take time to plan but the one thing you shouldn’t miss out in the rush to get ready for your driving break is to thoroughly check your car insurance policy. If you find it doesn’t cover you abroad, or it’s expensive to add this on, go online to compare car insurance, using a comparison website such as Insurancewide. It’s important not to just assume you are covered under your existing car insurance policy before setting off. If you are not it’s essential to compare car insurance nad get the appropriate cover.

You should also check the general rules of the road for where you are going – different places in Europe can have different speed limits, and different road customs in the event of a breakdown. For example, when you drive in Belgium, France and Germany you must have a warning triangle in your car.

So, it’s clear not only should you compare car insurance using a quick and easy insurance comparison site like Insurancewide, you should look into local road rules, and do your best to prepare for your trip. Carry identification with you at all times in case you are stopped by the local police and check basic maintenance such as oil and water levels before you go.

About Insurancewide

Insurancewide, also known as Insurancewide.com Services Limited, is an online insurance comparison website offering insurance comparison tools which allow users to search the market and procure the best insurance policies and quotes. Insurancewide was launched in August 1999 as the first insurance comparison website on the internet.

Via EPR Network

More Financial press releases