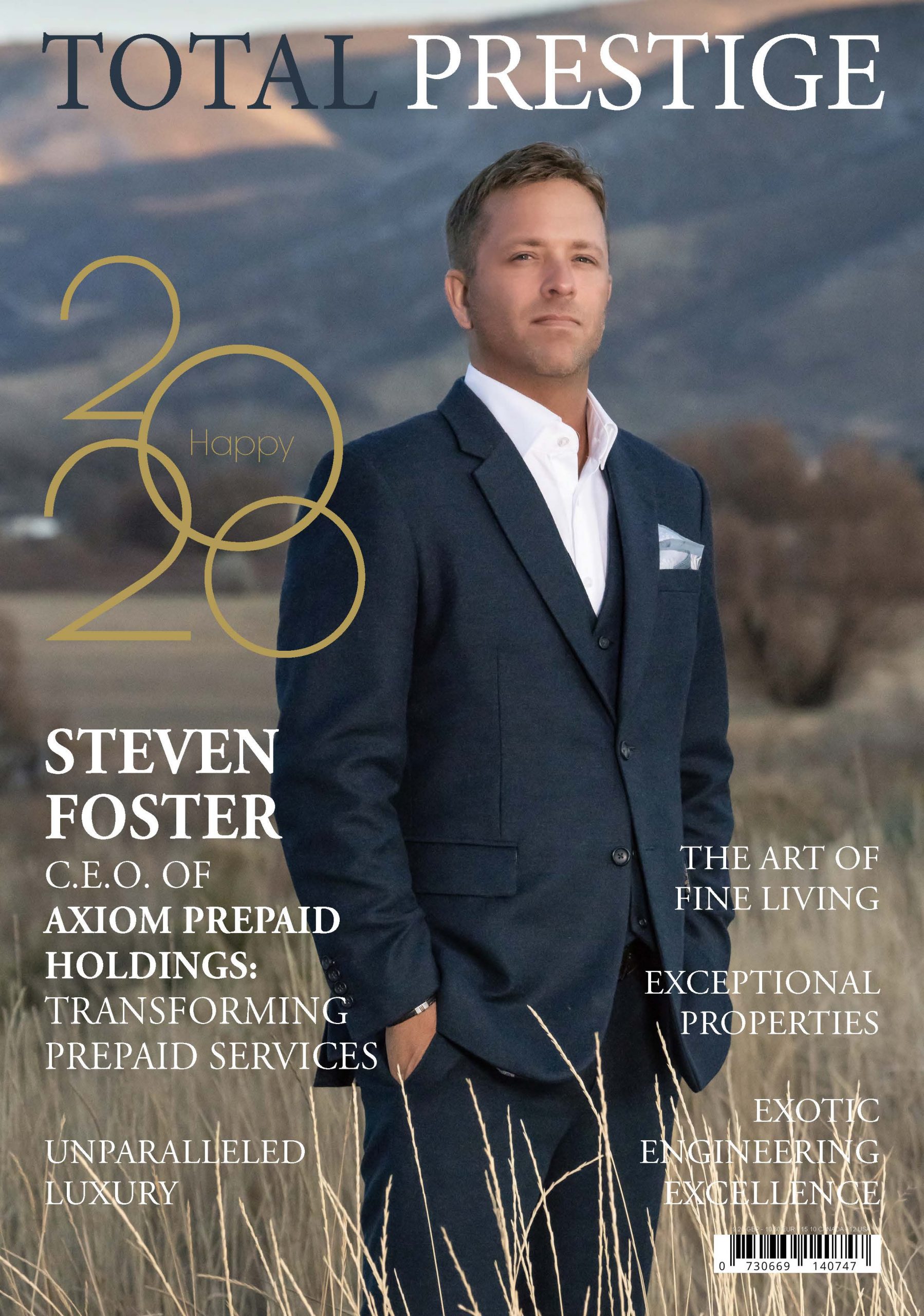

LONDON, 31-Dec-2019 — /EPR FINANCIAL NEWS/ — It seems only fitting that in a year filled with new product launches, new office openings and expansion across three continents, that Axiom Prepaid Holding’s CEO would grace the cover of Total Prestige Magazine’s January 2020 issue. After all, Steven Foster, a 40-something entrepreneur and banking industry veteran, has been at the helm of a company that has exceeded its growth expectations and then some, arguably vaulting the company to a leadership position in the prepaid card and app solutions arena. And Total Prestige profiles exceptional members of the business club of the same name, which is comprised of some of the world’s best-known business leaders as well as heads of start-ups and emerging businesses.

In 2017, Foster and his business partner, Steven P. Urry, set out to disrupt the banking industry with the launch of Axiom, which uses advanced digital tools to power prepaid Visa® and Mastercard® products, programs and services for consumers and businesses. They had one ambitious mission in mind: Simplify banking for all people – globally.

“We’d been firsthand witnesses from inside the banking industry to the significant shift in the availability of financial products. But it was notable to us that it was not carrying over to the prepaid space. No matter what country we visited, there was a gap in access to products engineered for the unbanked and global traveler. We decided to go all-in on launching a business that would turn the prepaid model upside down and give all consumers and businesses easy-to-use, digitally driven products and services,†said Foster.

That goal appears to have resonated broadly as this year alone, their enterprise:

• Expanded into Italy, Spain, Germany, France, Portugal, and Greece in Europe and grew the business in the Americas

• Entered the Asia-Pacific region

• Introduced brand- and revenue-building White Label Programs

• Rolled out hundreds of thousands of new prepaid cards, a plethora of new white label programs, including one that caters to the unique needs of millennials and Gen-Z

• Opened new offices in Romania

• Continued to invest in high-tech digital products to ensure the highest levels of intuitive, secure, compliant backend systems

As noted in the Total Prestige article, those accomplishments do not come without hard work and sacrifice. This year alone, Foster flew 725K miles for business and manages a workday that typically goes from 4 a.m. to 11 p.m.

“You can’t be an effective company leader if you aren’t in touch with your customers and employee teams. I meet them where they are to be sure I understand how their geography and culture may affect banking needs in each market. I try to give 150 percent every day so I can go to sleep knowing I did everything I promised and more for Axiom’s clients, my business partners and employees,†he said. “I have to spend a lot of time away from my wife and son so I want to be certain that the time I spend on-the-job truly counts.â€

“I’m very honored to be chosen for this feature article but I am just one part of the much bigger Axiom story. There would be no article if the company was not accomplishing what it set out to do. That has only been possible through the collective efforts of the entire Axiom team and my partner and friend, Steve Urry – and we are just getting started,†said Foster.

SOURCE: EuropaWire